Harley-Davidson Inc stock (NYSE:HOG) seems to only go down over the years, analysts don’t have a lot of faith in it, and Harley-Davidson keeps facing more and more financial hurdles… So how do I keep making easy money on HOG stock?

In 2014, HOG shares reached over $70/share, a price not seen since before the recession. Recently though, HOG sells for around $35/share, or half of it used to be worth.

In 2014, HOG shares reached over $70/share, a price not seen since before the recession. Recently though, HOG sells for around $35/share, or half of it used to be worth.

As of the end of February, 5 out of 22 analysts recommend HOG as a Buy (Source: Yahoo Finance) and that’s understandable: the stock is very cyclical and sees strong bull runs every year around key events such as earnings reports, announcement, and product launches.

Why aren’t analysts pumping HOG?

The other 17 out of 22 analysts aren’t recommending buying HOG stock, and that should come as no surprise either. Not only is the price per share always falling a little lower with each passing year, Harley-Davidson seems to be always surrounded by bad financial news, such as:

- Production and recall issues along with poor sales on the LiveWire, their first electric motorcycle that failed to change the game

- Underwhelming earnings reports after suffering tough blows from Trump government trade wars followed by coronavirus lockdowns

- Pulling out of the Indian market, which Harley hoped would have added increased revenues, but may now face a potential backlash of lawsuits instead

- Killing off the Street 500 and Street 750 motorcycles which were designed to bring in the younger audience they really need to keep the company alive

I have no financial training, and I’m not offering financial advice. I’m here to show you how I make some money by strategically buying and selling HOG shares at key times of year, despite Harley-Davidson facing a difficult financial future.

I have no financial training, and I’m not offering financial advice. I’m here to show you how I make some money by strategically buying and selling HOG shares at key times of year, despite Harley-Davidson facing a difficult financial future.

How to make money trading Harley-Davidson (HOG) stock

I’m not a finance guy. I’m a motorcycle guy who could stand to make a few extra bucks, so I found a basic simple way of buying and selling HOG shares a couple times a year to make a decent profit.

1) Be ahead of the curve

Earlier I mentioned that HOG “sees strong bull runs every year around key events such as earnings reports, announcement, and product launches.” News is a major catalyst for stock prices, meaning HOG prices rise and fall on news. Duh, so what?

I make money trading HOG by knowing when Harley-Davidson will have positive news coming up, and buying well before the news comes out. Once positive news comes out it excites fans and investors, typically raising the stock price. That’s when I sell my shares and walk away with profits.

2) Identify what news will make Harley-Davidson’s stock price rise

I stay away from quarterly earnings reports because it’s too difficult to predict what they will be and how the market will react to them (more on that later). Instead I focus on the two types of events that almost always seem to get people excited about Harley-Davidson: the annual dealer meeting, and the new vehicle launches.

Harley-Davidson holds an annual dealer meeting where they show off model improvements, new parts, gear, merchandise, and marketing plans. They also sometimes launch new vehicles as separate events. Both events typically drive up the stock prices, perfect for making good short term gains and then cashing out.

3) Sell before the price comes down again

It’s a simple strategy: Know what’s going to be happening with Harley-Davidson, identify what pieces of news will be profitable, avoid earnings reports, and sell out. The stock market is risky, and HOG stock has been going down for years, so I never want to hold it for too long.

Experienced traders have plenty of advanced tools for determining the best times to sell out but a good general rule for a beginner investor is “If your gains are so good that you’re starting to brag to people about them, it’s time to sell.” I typically sell on the day of the event or the morning after. Experienced day traders can also make a few 0.5% to 1.5% gains by taking advantage of bullish price volatility after that.

Questions and answers to help you get started trading HOG stock

How do I get ahead of the curve and know when Harley-Davidson has events coming up?

I sign up for free email alerts from Google Alerts. They email me when new content comes out with keywords I sign up for, like “HOG NYSE” or “Harley-Davidson dealer meeting”.

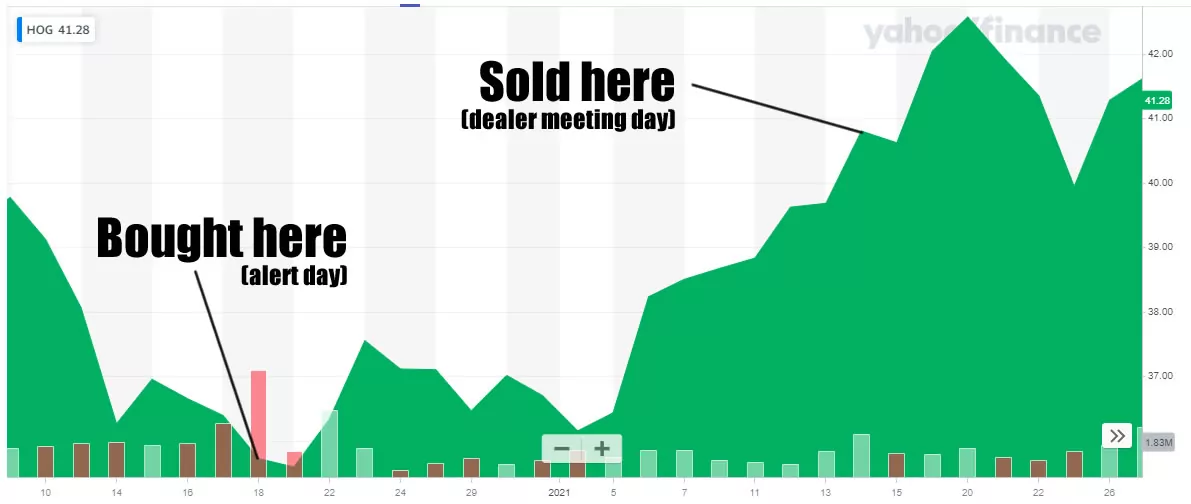

On December 18th I received a Google Alert email that DealerNews mentioned Harley-Davidson having a dealer meeting on January 14th.

How much can you make on a deal with an alert?

Your return will depend on how much you invest. After receiving the December 18th alert I bought HOG stock at $35.09/share. On January 14th, during the dealer meeting, I sold my shares for $41.35 per share. That made me a 17.8% return on investment in less than a month.

To put that into dollars, if you had invested $5,000 and bought and sold with me, you would have made about $900 in profit for holding HOG shares for less than a month.

Can you make money after that?

Yes, if you did a little day trading to take advantage of the bullish price volatility in the 48 hours after these events you could have added a few hundred dollars more. It can be a great opportunity for experienced day traders.

Are there other ways of getting updates on events like this?

Google Alerts aren’t the only way to know what’s coming up for Harley-Davidson. You could also try the following:

- Signing up for Harley-Davidson’s own newsletter from the bottom of Harley-Davidson.com

- Checking out all of the content on Harley-Davidson’s Investor Relations website

- Calling up your local dealership at the start of every month and ask them if there’s any Harley news coming up

I like the alerts best because once I set them up how I want them, any new information comes directly to me.

What happened after the dealer meeting?

For the first two weeks the stock price stayed relatively strong. After that the price dropped and it was worth less than I bought it, before a market correction in February returned it to around my December buying price.

I could have lost my 17% profit, and possibly even some of my principal. This is why I don’t hold HOG shares for very long.

Why not buy and sell around quarterly earnings?

Why not buy and sell around quarterly earnings?

Even with understanding the powersports market, having friends who own dealerships, and looking at sales data, I still avoid trying to time the market around quarterly earnings reports for two reasons:

Firstly, earnings are compared to the company’s estimated earnings, so even if the company is very profitable, the stock price could still fall if it’s less profitable than anticipated. Secondly, investors have their own earnings expectations, and they can be unreasonable, unpredictable, emotional and prone to overreactions. Not my cup of tea.

Closing thoughts

The majority of analysts aren’t buying HOG stock now and neither will I. I’ll be patient, look at what major catalysts Harley-Davidson has coming up, identify which ones will have positive impacts on the stock price, try to be well ahead of the trend, and sell as soon as I can.

Remember, the stock market is dangerous and nothing is guaranteed, but good hype drives prices up and we can take advantage of that.

COMMENTS: What would you do with an extra $900 of profits made from your HOG trade? Leave me a comment!

YouMotorcycle Motorcycle Blog – Motorcycle Lifestyle Blog, MotoVlog, Motorcycle Reviews, News, & How-Tos

YouMotorcycle Motorcycle Blog – Motorcycle Lifestyle Blog, MotoVlog, Motorcycle Reviews, News, & How-Tos

Cool stuff you got there, pal! I’m amazed at the stock rides you upgrade. By the way, may I know if you have a brand preference for motorcycle exhausts?

Not really. I think different brands specialize in different areas. You don’t see Two Bros making cruise exhausts, you don’t see Vance & Hynes making sport bike exhausts, etc. Because I ride/own a variety of motorcycles, I’m not married to any one particular brand of exhaust. Is there a particular bike you’re looking for a recommendation on?

And……NOW for a comment on the actual subject of your article!

1) Be ahead of the curve

……..” News is a major catalyst for stock prices, meaning HOG prices rise and fall on news…..

I make money trading HOG by knowing when Harley-Davidson will have positive news coming up, and buying well before the news comes out. Once positive news comes out it excites fans and investors, typically raising the stock price. That’s when I sell my shares and walk away with profits.”

Good onya for making an easy grand, Adrian.

We “semi-professional” investors have an age-old saying that describes your strategy to a T…it’s called “Buy the rumour, Sell the news”!

And when you think about it, that’s exactly what you do/did!

Of course, being “a player”, i.e. knowing what the hell is going on in any particular industry segment before most OTHER people do….AND acting on it….is key to the strategy. And YOU, as a motorcycle blogger extraordinaire, are of course perfectly positioned to “get the scoop” (the “rumour”) ahead of all us wannabe’s!

And as long as you’re not the VP Marketing of Harley…..you’ll never get nailed for trading on insider information!

Cheers, bud.

Thanks Mike, gotta take the easy wins when you can sometimes!

Super vidéo! You played your hand perfect Adrian